Analysts: Uranium prices down but should increase long term

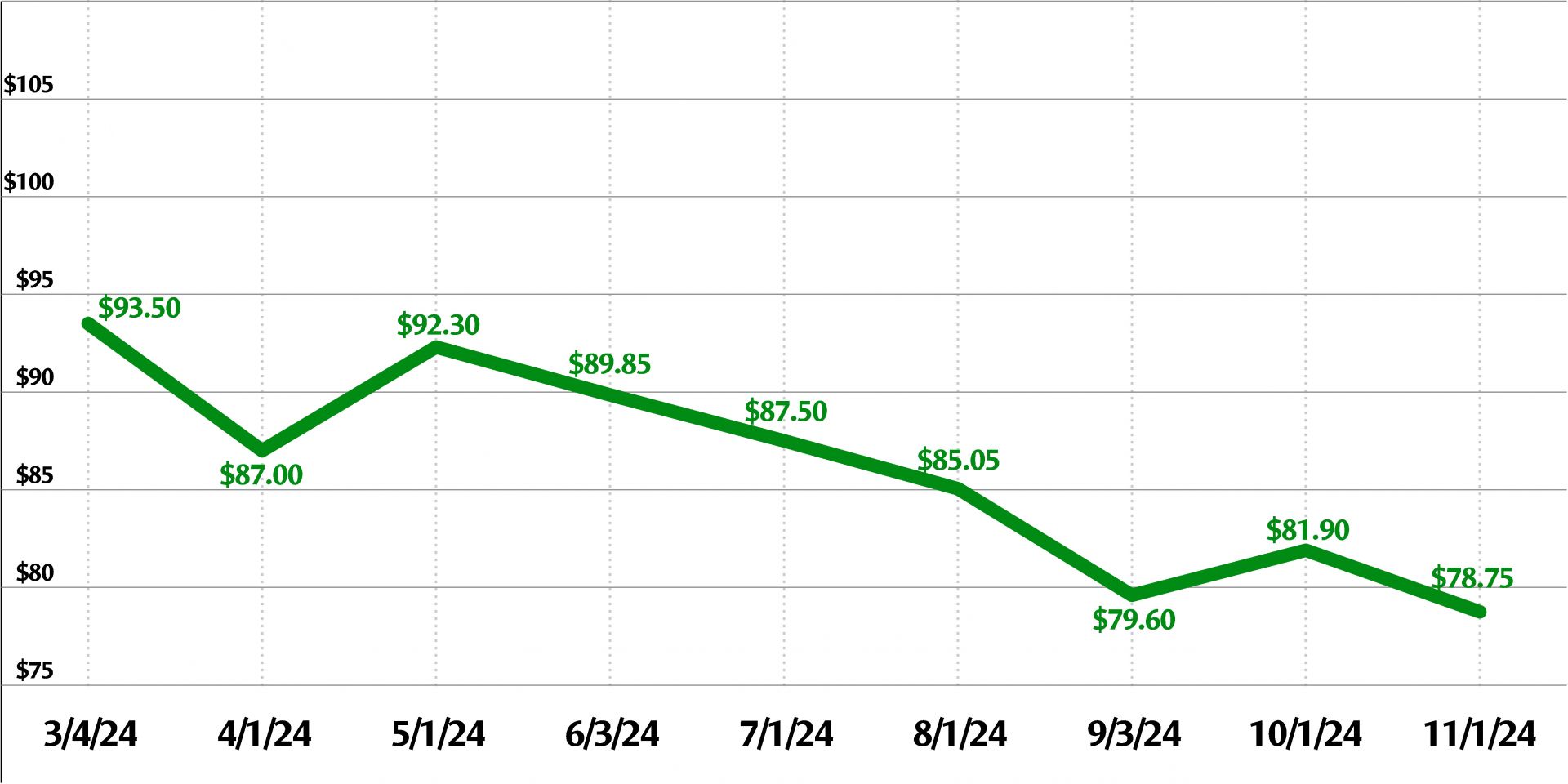

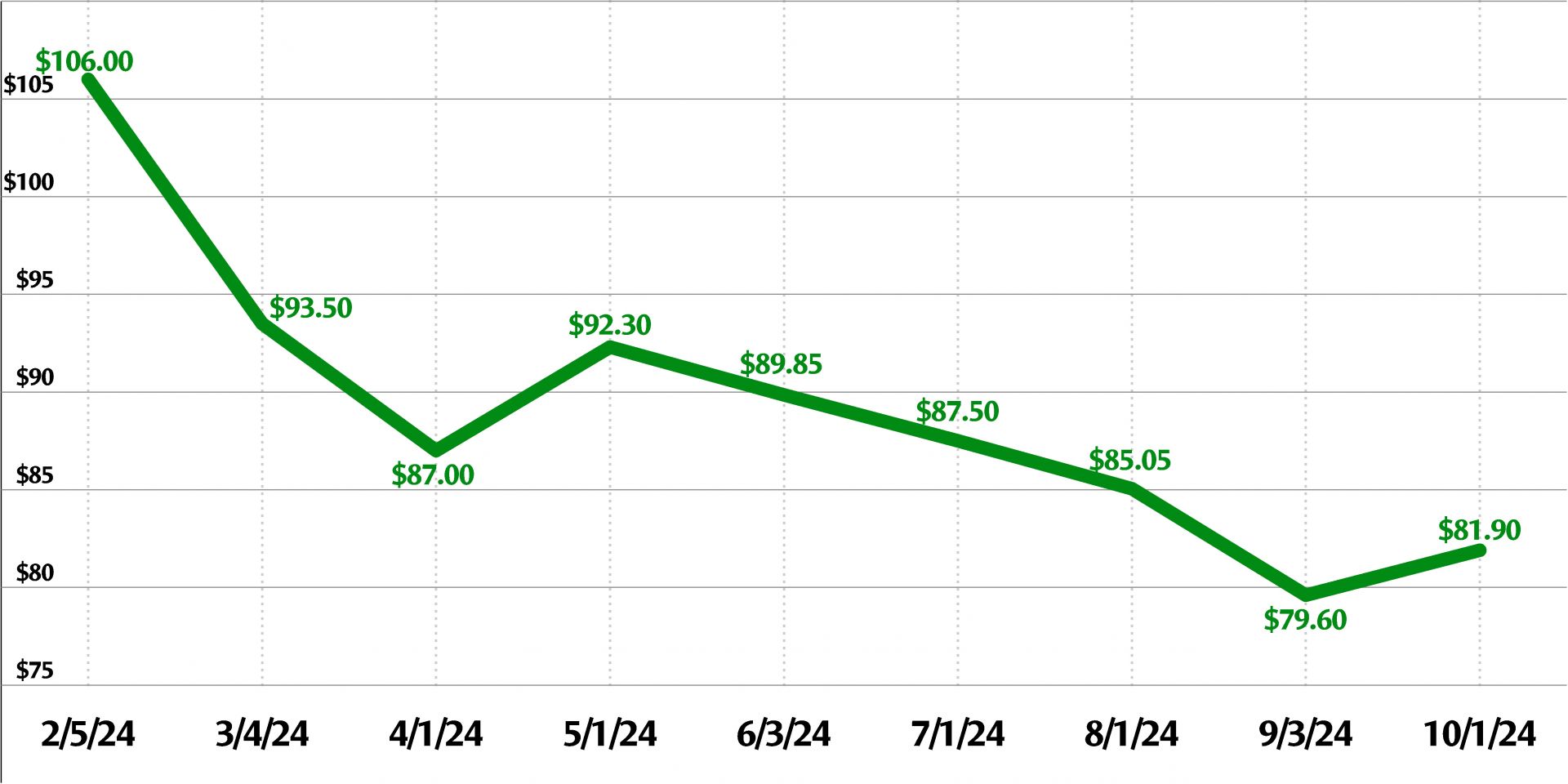

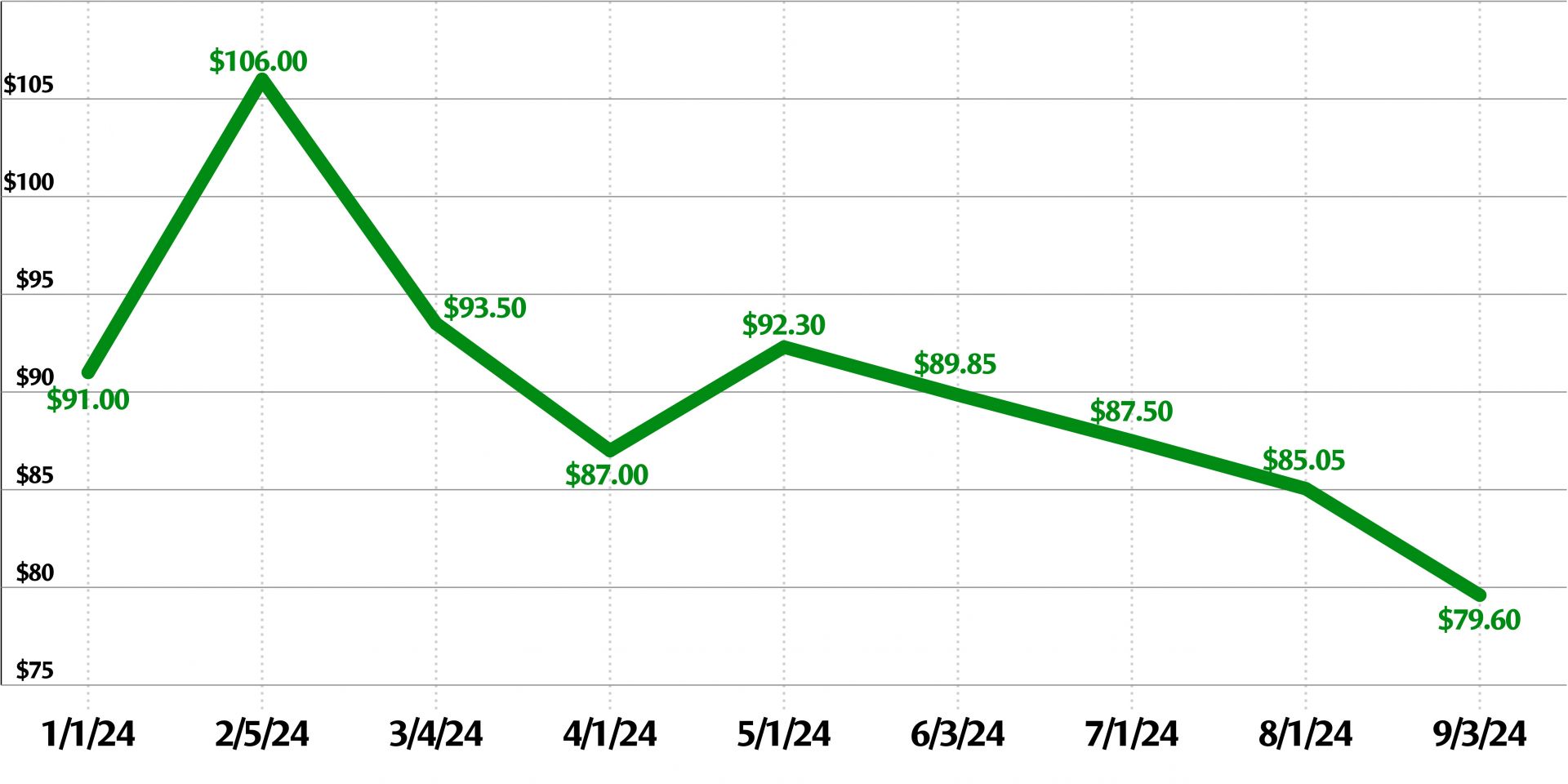

New York City–based analyst firm Trading Economics has reported that uranium prices have fallen $13.20 per pound, or 14.51 percent, since the beginning of 2024, with the price on December 3 down to $77.80 per pound. A graph of prices for the year shows a jagged downward slide since a peak of about $107 per pound in early February. The all-time high for uranium prices was $148 per pound in May 2007, according to the firm.